Small Business Software Solutions

It brings most of the features of the online platform, plus it enables mileage tracking and receipt capture for quick and convenient recordkeeping. QuickBooks Online is a good option for many small businesses that are looking to make invoicing customers easy sign up for quickbooks online accountant and integrate invoicing and payments into the general ledger. Small businesses can customize how they use the platform so that they only use the features they need.

Join 4.5 million QuickBooks users around the world

QuickBooks Pro Plus has a full range of features including invoicing, inventory tracking, reporting, billing, and income and expense tracking. If you’re looking for non-QuickBooks desktop-based software, we recommend the desktop-based Sage 50 Accounting for midsize and large businesses. As with other QuickBooks products, users can choose to try QuickBooks Payroll free for 30 days or get 50% off the base price for three months. In my review, I found that QuickBooks Online is the best Intuit QuickBooks accounting product for most small, midsize and growing businesses.

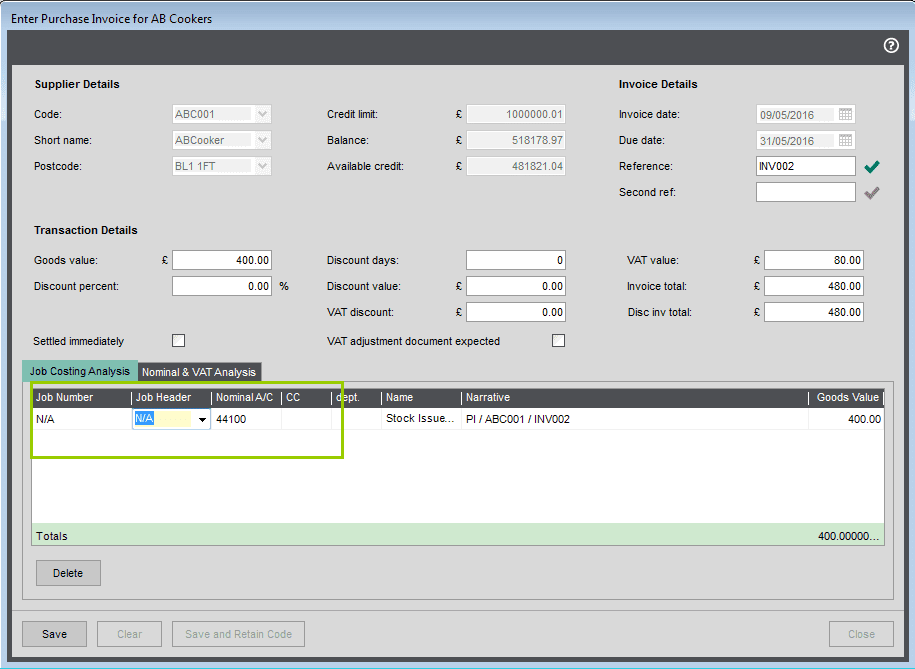

- If you have a record of bills available, you can track upcoming payments easily to ensure timely payments of bills.

- Since your software for accounting is connected to the cloud, they can use their own login to access reports like the general ledger, balance sheet, or cash flow statement whenever they need.

- Support is limited, so users are left reading help articles rather than getting a live person to help.

- Take control of your finances with QuickBooks small business accounting software.

Which Intuit QuickBooks accounting software product is right for my business?

They’ll happen automatically, so you’ll always be working with the most current version. If you’re like a lot of people, you immediately close out that distracting popup—and then you do that very same thing for the next several months. Before you know it, you’re operating with software that’s several versions behind (and, as a result, vulnerable to all sorts of threats and bugs). You’re looking through your bookkeeping records, getting an idea of your business’ financial standing for this quarter. Then you realize that this report is outdated and missing several important pieces of data, meaning it isn’t at all accurate. Access your books, anytime, anywhere, so you’re always on top of your business’s financials.

If you have a record capital and current account of bills available, you can track upcoming payments easily to ensure timely payments of bills. Invite your accountant to access your books for seamless collaboration. Give employees specific access to features and reduce errors with auto-syncing. Protect sensitive data with user-access levels and share reports without sharing a log-in.

Best of all, your information is automatically backed up, so you never need to save your work. A seasoned small business and technology writer and educator with more than 20 years of experience, Shweta excels in demystifying complex tech tools and concepts for small businesses. Her work has been featured in NewsWeek, Huffington Post and more.

You can take a printout of these statements for your accountant and send it across to them at the time of filing or invite them to view these statements without needing a login ID or password. As a business owner, you know how important it is to manage a regular positive cash flow. QuickBooks Payments makes it easier for you to accept online payments when you send invoices from within the app. While setting up QuickBooks, you can connect your bank as well as credit card accounts to the software. Once done, QuickBooks tracks your bills and expenses automatically. Our accounting software makes it easy for small businesses to connect with apps leveraged finance levfin you already use or discover new ones.

Plus, turn quotes and estimates into an invoice in just a click from any device. In this episode, Harlem chocolate Factory founder Jessica Spaulding recalls a few of her early money management mishaps, and three big lessons learned. Set up auto-pay for your team and rest easy with taxes calculated for you. Tag things as you work to track events, projects, locations, and anything that matters.

Is QuickBooks Online Right for You or Your Business?

Larger businesses with sophisticated inventory, reporting and accounting needs. However, if you’re familiar with QuickBooks’ interface, recently hired your first employee and want to start running payroll as painlessly as possible, QuickBooks Payroll is the simplest solution. In other words, you don’t need to worry about suddenly losing product support if you choose QuickBooks Enterprise. The product is a top choice for accounting firms and enterprises in industries across the world, so it should be here to stay. If you waive your free trial and choose to take 50% off for three months, you’ll pay just $10 a month for three months.

And with four plans, QuickBooks Online gives growing businesses room to expand into more complex plans with advanced accounting features. Small business accounting software is a digital investment that replaces the process of collecting receipts and manually recording business expenses and revenue. Furthermore, investing in accounting software for your small business is more affordable than hiring an accountant.

Features for all kinds of businesses

Our partners cannot pay us to guarantee favorable reviews of their products or services. However, QuickBooks has no plans to phase out QuickBooks Desktop Enterprise. Additionally, customers in regions outside of the U.S. should be able to access their region’s desktop-based QuickBooks software for the foreseeable future. If you want non-enterprise desktop software from QuickBooks, you’ll need to purchase the product on or before July 31, 2024. After that point, new sales will end, but existing customers will retain access to their software program. Those who want to take their accounting on the go will appreciate the mobile app.